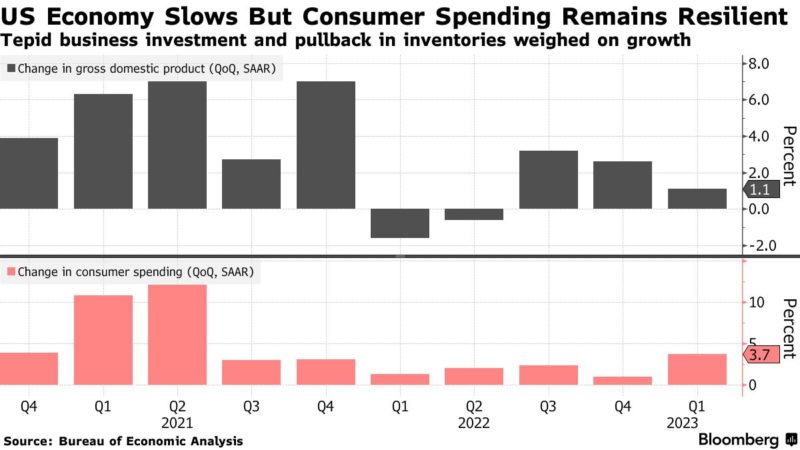

US economic growth slowed in the first quarter by more than expected as tepid business investment and a pullback in inventories tempered a pickup in consumer spending.

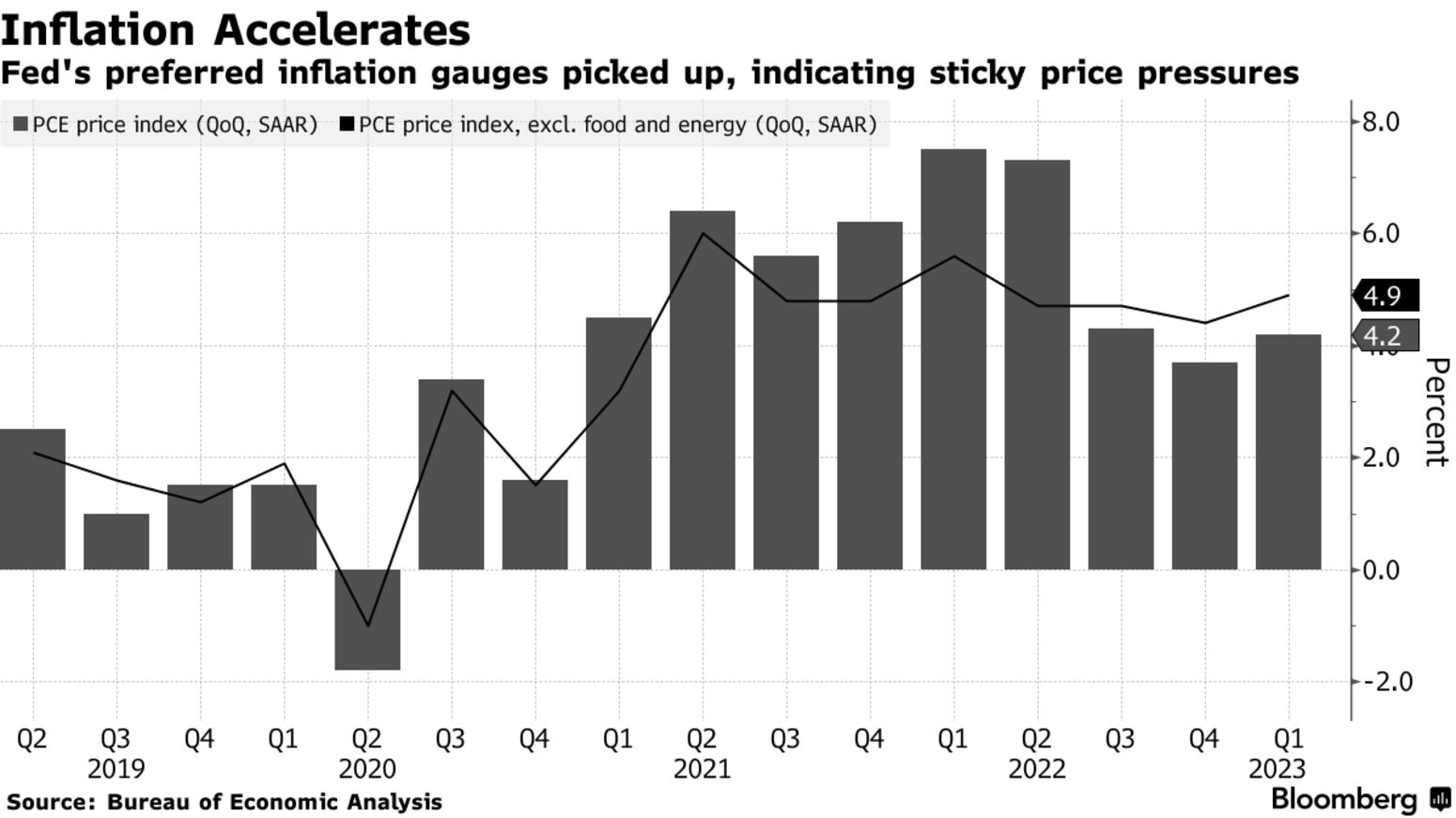

Gross domestic product rose at a 1.1% annualized rate on the back of the strongest consumer spending in nearly two years, the Commerce Department’s initial estimate showed Thursday. The Federal Reserve’s preferred underlying inflation metric accelerated to a one-year high.

The 3.7% increase in consumer spending reflected gains in both goods and services, including a surge in purchases of motor vehicles. Business investment in equipment posted the biggest drop since the start of the pandemic and inventories subtracted the most from GDP in two years.

The figures illustrate economic growth that is gradually downshifting under the weight of Fed interest-rate hikes and elevated inflation. While the economy bounded ahead at the start of the year, helped in part by unseasonably warm weather, households and businesses pulled back on spending as the quarter progressed.

The outlook depends largely on the resiliency of the job market. Low unemployment and persistent wage gains have so far allowed consumers to weather high inflation and keep spending.

Follow the reaction in real time here on Bloomberg’s TOPLive blog

The personal consumption expenditures price index grew at an 4.2% annualized pace in the January to March period. Excluding food and energy, the index rose 4.9%, faster than forecast and the most in a year. March data will be released Friday. Services inflation remained hot while prices of non-durable goods accelerated.

The inflation and consumer spending figures likely keep the Fed on track to raise interest rates by a quarter percentage point next week. First Republic Bank’s continuing struggles, however, do raise the possibility that the central bank could pause.

“Inflation remains stubborn, and along with the continued strength in the labor market, it should keep the Fed on pace for a May and potentially a June rate hike,” said Cliff Hodge of Cornerstone Wealth.

The median projection in a Bloomberg survey of economists called for 1.9% GDP growth and a 4% annualized gain in personal consumption. The S&P 500 opened higher, Treasury yields jumped and the dollar strengthened after the release.

Separate data out Thursday showed applications for unemployment benefits fell for the first time in three weeks. Continuing claims, which can offer insight into how quickly out-of-work Americans are able to find a new job, were largely unchanged.

Headwinds Ahead

The economic slowdown is expected to be more evident in the second quarter, with economists forecasting GDP to grow at a stall-speed pace of 0.2%. The Fed’s April Beige Book survey of regional business contacts indicated the same, with policymakers describing economic activity as “little changed” and consumer spending as “flat to down slightly.”

While a recession isn’t assured, many economists — including those at the Fed — expect the cumulative effect of monetary tightening, a retrenchment in business investment, a slowdown in consumer spending and tightening credit conditions to ultimately tip the economy into a downturn.

“Recent data signal that soft economic growth continues into the second quarter,” said Kathy Bostjancic, chief economist at Nationwide. “Meanwhile inflation, especially at the core services level remains elevated and sticky – an unfavorable mix of slower growth but still high inflation.”

The GDP data showed services spending rose at a 2.3% annualized rate, led by health care and restaurants and hotels. Outlays on goods increased at a 6.5% rate, the most in nearly two years. Inflation-adjusted spending data for March, and any revisions to prior months, will also be released Friday.

The slowdown in business investment reflected a drop in equipment purchases and the smallest gain in intellectual property outlays in nearly three years.

Many companies are dialing back investment plans in the face of tighter credit conditions and recession concerns. Economists generally see a significant pullback in capital spending as a key factor of any downturn this year.

Meanwhile, inventories subtracted 2.26 percentage points from GDP during the period. Residential investment weighed on growth for an eighth straight quarter, reflecting the damage inflicted on the housing market from a spike in mortgage rates. This particular headwind to growth is abating though — other figures suggest the sector is beginning to stabilize.

Stripping out those components, inflation-adjusted final sales to private domestic purchasers — a key gauge of underlying demand — increased by the most since the second quarter of 2021 after stagnating at the end of last year. The figure was boosted by strong consumer spending.

Source: bloomberg.com