The number of ‘cost-burdened’ renters hit a record 22.4 million in 2022 — up 2 million households from just three years before, according to a new study

Rent has never been less affordable — for tenants with high and low incomes alike — even while costs for new leases are finallycooling off.

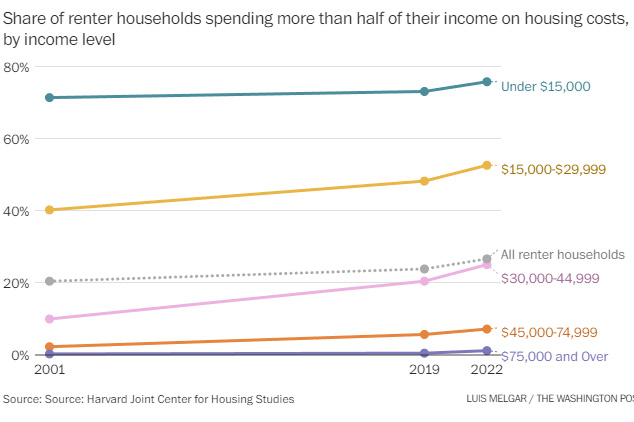

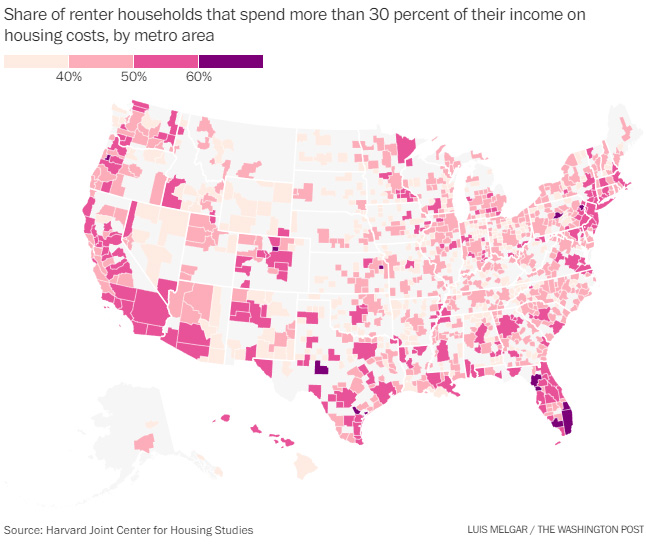

Half of American renters spend more than 30 percent of their income on housing costs — a key benchmark for affordability — with the financial strain rising the fastest for middle-class tenants. That’s according to a new report from the Harvard Joint Center for Housing Studies, which found that the number of such renters, considered to be “cost-burdened,” hit a record 22.4 million in 2022 — up 2 million from just three years before. And of those households, 12.1 million had housing costs that ate up more than 50 percent of their income, an all-time high for those with “severe burdens.”

Practically no renters were spared from the pandemic-era surge in housing costs. Prices rose the fastest — a whopping 5.4 percentage points — for middle-class households making $45,000 to $74,999. And it ticked up a notable 2.6 percentage points for those earning $30,000 to $44,999. The country’s highest and lowest earners also saw their burdens increase.

“I expected to see it worsen,” Whitney Airgood-Obrycki, the report’s lead author, said of the affordability problem. “But the degree to which it worsened, I think, was astounding.”

The report, which draws from recently released data from the 2022 American Community Survey, comes as rent is still the nation’s main driver of inflation. Other causes of historic price hikes — like supply chain backlogs or worker shortages — have improved significantly, helping stabilize overall inflation. But high rent continues to take up a large share of people’s individual budgets.

Last year brought some long-awaited change for the country’s 44 million renter households. In the fall of 2023, rent growth for professionally managed apartments plummeted to just 0.4 percent, down from 15.3 percent in early 2022, according to RealPage. Economists are waiting for the shift to show up in official inflation statistics. But even if increases slow, rent costs aren’t expected to go back to pre-pandemic levels, crowding out more and more tenants with already-constrained budgets.

The challenge has drawn policymakers’ and economists’ attention at various times over the past few years. In 2021, coronavirus aid legislation allocated billions of dollars in emergency rental assistance, but federal funding was slow to get out the door. The Biden administration tried to preserve a national eviction moratorium to stave off a wave of homelessness, but the protection was ultimately struck down by the Supreme Court. And last year, the White House announced new actions to protect tenants as officialscame under pressure to address soaring costs.

But advocates and housing experts note that the country’s housing issues aren’t limited to acute crises. The overall market stayed hot even as the Federal Reserve hoisted interest rates, spurring a steep run-up in mortgage rates. Some households have been unscathed, especially if they have enough cash on hand to buy a home, or if they already own a home andcan stay put in a house they snagged for a low rate years ago. But in many cases, renters have fewer ways to make the math work.

A big reason is that there just aren’t enough units available. There’s been progress, with tens of thousands of newly constructed homes expected to become available this year. But the Harvard study notes that the benefits won’t be felt equally — and that the fresh supply won’t tame housing costs for renters across the spectrum.

For starters, new construction often targets the higher end of the market, and thoseprices can stay high because there’s still plenty of demand among wealthier tenants. At the same time, there’s been a culling of lower-cost units as landlords chase higher rents or sell properties or asmore affordable units fall into disrepair. In 2022, only 7.2 million units posted rents under $600 — a loss of 2.1 million units compared with a decade before, when adjusted for inflation.

“Supply is very important. I will certainty underline that,” Airgood-Obrycki said. “But the people who are most cost-burdened are not going to see the immediate benefits of that supply.”

What happens in 2024 and beyond remains to be seen. The report itself doesn’t make specific forecasts, and 2023 census data won’t be released until later this year. But there’s little expectation that rents will drop — or that the overall housing market will suddenly transform into a more even playing field.

“We may have come down from the all-time high number,” Airgood-Obrycki said. “But we’re probably still in pretty bad shape.”

Source: washingtonpost.com