Housing affordability continues to decline as the hot real estate market fuels skyrocketing prices. Incomes aren’t keeping pace with the higher prices.

The median family income rose by 1.2% in May while the monthly mortgage payment jumped by 20%, according to the National Association of REALTORS®’ Housing Affordability Index.

Even as mortgage rates are down compared to a year ago—which has helped buyers save on borrowing costs—the median existing-home price has jumped 24.4% compared to the same period.

Monthly mortgage payments increased to $1,204 in May, a 20% jump compared to a year earlier. NAR’s analysis notes the annual mortgage payment—as a percentage of income—increased to 16.5% over the past year due to higher home prices and a decline in median family incomes.

Homeowners in the West have the highest mortgage payments to income share at 22.1% of income. Home prices in the West have climbed to a record high of $513,700.

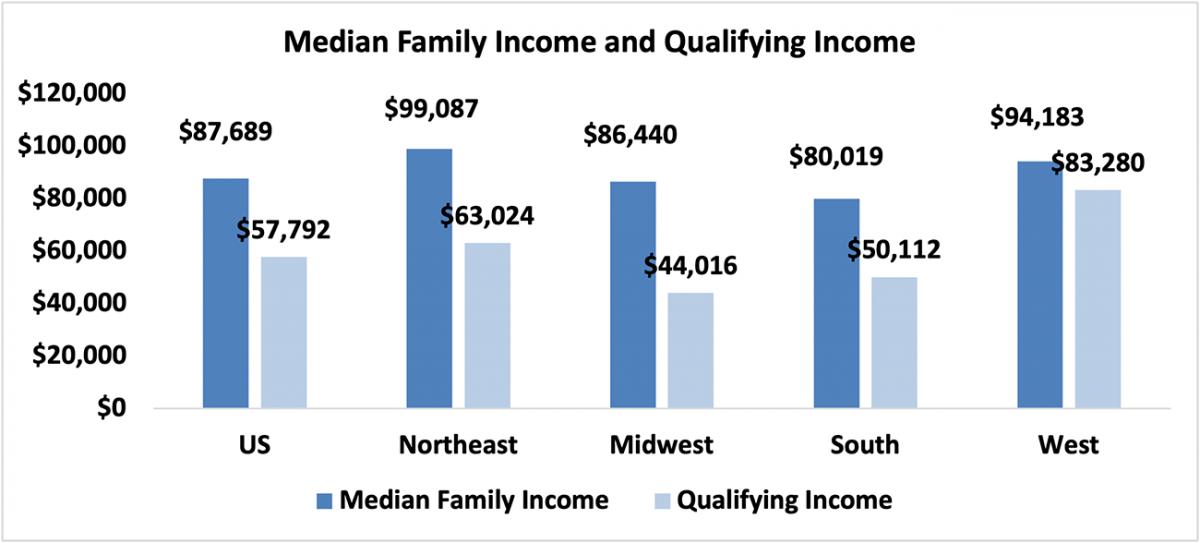

The most affordable region of the U.S. in housing continues to be the Midwest, in which the median family income is $86,440. NAR’s index calculates a qualifying income as the income required to afford a mortgage so that payments are no more than 25% of a family’s income. The Midwest had a qualifying income of $44,016.

View a further breakdown of the data in NAR’s Housing Affordability Index.

Source: “Housing Affordability Falls in May as Home Prices Rise Faster Than Income,” National Association of REALTORS® Economists’ Outlook blog (July 9, 2021)