As interest rates fall, growing loans is getting more important, but also trickier

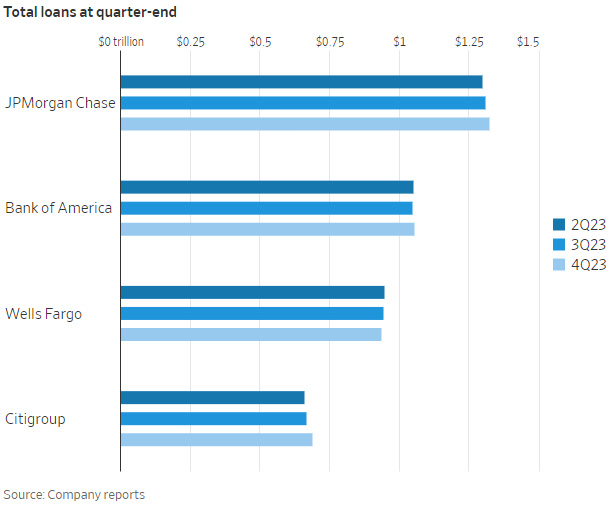

Even as the biggest banks have grown and diversified, lending remains a core part of their business. And it looks like that will get tougher this year.

The outlooks that banks gave on Friday for 2024 net interest income—a measure of what they earn on yield from cash, loans and securities, minus what they pay in interest costs—were muted. JPMorgan Chase expects it to be about flat versus 2023, while Wells Fargo anticipates a potential decline of about 7% to 9%, and Citigroup expects their core net interest income to be “down modestly.”

Wells Fargo average deposits were down 3% from a year earlier. PHOTO: ANGUS MORDANT/BLOOMBERG NEWS

Those projections of course are affected by interest-rate policy. If the Federal Reserve cuts rates in 2024, that makes it harder for banks to enjoy the surge in interest earnings of the past couple of years. While deposit cost pressures might ease, so will gains from loans or cash that rose with rates.

Still, banks can grow net interest income if they are lending more. But banks are looking at a more difficult environment for loans in 2024.

Consumers are expected to keep borrowing more on their cards, especially as they run down what remains of their pandemic-boosted savings. But the pace of growth will slow in 2024, JPMorgan told analysts. And the credit performance of card loans will likely decline, again as pandemic stimulus benefits retreat further into history.

JPMorgan anticipates the net charge-off rate for cards to be below 3.5% in 2024. It was 2.79% in the fourth quarter of 2023. That doesn’t represent a major concern, as the bank still considers that to be within the bounds of “normalization.” But it is a potential headwind nonetheless.

The commercial side of things also won’t be getting easier. Though commercial real estate is not a major part of the biggest banks’ overall business, the difficulties in office lending will be one drag on wholesale lending. JPMorgan described “muted demand for the new loans as clients remain cautious” to analysts, in reference to commercial-and-industrial lending.

Losses on commercial loans overall are still fairly low, but like in cards, ticking higher. Bank of America’s overall commercial net charge-off rate jumped in the fourth quarter, to 0.19%, from 0.09% in the third quarter. JPMorgan’s net charge-off rate on retained wholesale loans was 0.31% in the fourth quarter, up from 0.06% in the third.

Meanwhile, banks’ resources are getting a bit tighter. While megabanks still enjoy relatively cheaper deposits than their regional peers, they also aren’t seeing those deposits grow in size as buoyantly as they did in the past. JPMorgan said that its average deposits were flat year-over-year in the fourth quarter, even as it absorbed First Republic during 2023. Bank of America’s average quarterly deposits were down slightly from a year earlier. Wells Fargo average deposits were down 3% from a year earlier.

Banks also have to consider their capital usage. More lending can increase the risk measures of banks’ assets, which pressures their capital ratios. But banks are widely trying to tamp down their risk-weighted asset growth as they prepare themselves for rising Federal Reserve capital requirements. Special Federal Deposit Insurance Corp. charges related to uninsured deposits, which banks are reporting this quarter, were also a drag.

The biggest banks still have plenty of resources to run massive loan books. But at the margins, these pressures mean that growing them rapidly is trickier: More loans are probably going to not be repaid, and they could still be more challenging to fund.

That may be an important factor for banks’ earnings this year—and the U.S. economy that relies on them for credit.

Source: wsj.com